Texas Medicare insurance should be easy. Get the help and benefits you deserve today.

Texas Medicare insurance should be easy. Get the help and benefits you deserve today.

You have been enrolled in Medicare Part A and B, now what? Traditional Medicare in Texas should by no means be considered adequate coverage. It does provide an excellent starting point but for folks on a fixed income as most seniors are, there are numerous out of pocket situations that you will find yourself in. There are inpatient deductibles, out patient deductibles and cost sharing on your part that could leave seniors tapping into their retirement funds just to get medical treatment. That’s where Texas Medicare Supplement Insurance comes in handy. If you are just not sure what you have you should probably check your Texas Medicare Eligibility and Enrollment Requirements.

Medicare Alone May Not Be Enough

There are some heavy handed cost sharing and coinsurance with Medicare that without a supplemental plan from a major company like United of Omaha or Blue Cross Blue Shield of Texas, you will find having a medical emergency or even a normal doctor visit will potentially take food off the table.

Traditional Medicare typically pays 80% of your medical expenses and has enormous deductibles for both Part A and Part B. In some cases you could find themself in a situation where the Part A deductible, which for 2013 is $1,184 for each benefit period, not yearly and the Part B deductible comes in at $147 yearly. Also traditional Medicare is set up for you to be responsible for heavy cost sharing when treatment exceeds 60 days, to the tune of $296 a day that would be your full responsibility as well as $596 days 91-150. You would also be forced to use a doctor or hospital that accepts Medicare Assignment, otherwise you would also be charged for any and all excess charges. Medicare Assignment means the provider has agreed to take whatever fee the government pays them. The ideal solution would be to have a plan that paid ALL of the charges over what your Medicare plan pays, leaving you owing nothing, you can do this through supplements.

How do Texas Medicare Supplements Work?

Well, for starters they are sold by private insurance companies like Aetna,Blue Cross Blue Shield of Texas, United HealthCare and United of Omaha, a Mutual company all of course under the watchful eye of Medicare. These plans are all the same based on a alphabetic numbering system. So a Plan F from United of Omaha is exactly the same as a Plan F from Forethought Life Insurance Company and will look identical in benefits. Now its all about cost.. who has the lowest cost plan?

Depending on the plan you select your Texas Medicare Supplemental Insurance policy, or MediGap as some people refer to it as, can be structured to pay any and all charges you standard government plan doesn’t. Deductibles, both A and B and any cost sharing or coinsurance can be eliminated with the correct Texas MediGap Plan and you can go to any doctor that takes Medicare, there are no networks to choose from. The most popular plan is and always has been Plan F because it offers the most peace of mind by eliminating ALL deductible, coinsurance and cost sharing, however that does not mean it’s the best for you. Always look at or have explained all of the plans in order to make the correct decision. The second most popular plan is Plan G which looks exactly like Plan F but you will pay the Part B deductible and the monthly premiums are always lower on Plan G.

There is a monthly premium a consumer pays for Texas Medicare Supplemental Insurance, less benefits equals less monthly premium. There is also no medical underwriting on Medicare Supplement Insurance in Texas when someone is turning 65 so that is always the best time to enroll. Rates are different for each different plan. Plan N will have a different rate than for benefits included in Plan A and rates are also based on your age. You will also see different rates based on your zip code so someone in Houston will pay a different monthly price than someone living in say Dallas, East Texas or Austin. Getting a Medicare Supplement Quote in Texas is easy but all the above factors do come into play.

The United States Government sets the standards on these plans and every now and then makes changes to them like they did in 2010. The changes amounted to the elimination of several plans like Plan J and the introduction of a few new one like the popular Plan N benefit package. This one is getting allot of play because it seems to be an adequate alternative to the Medicare Advantage Plans that seem to be on the chopping block in the new health care reform law.

As I mentioned earlier there is no medical underwriting right around the time you are turning 65 so of course that is the proper time to purchase a Texas MediGap policy however underwriting requirement are so much more relaxed when you compare it to traditional individual health insurance for someone under 65, like say 50. Most consumers are approved and we will be happy to give you our thoughts as to if you can get approved, just give us a call.

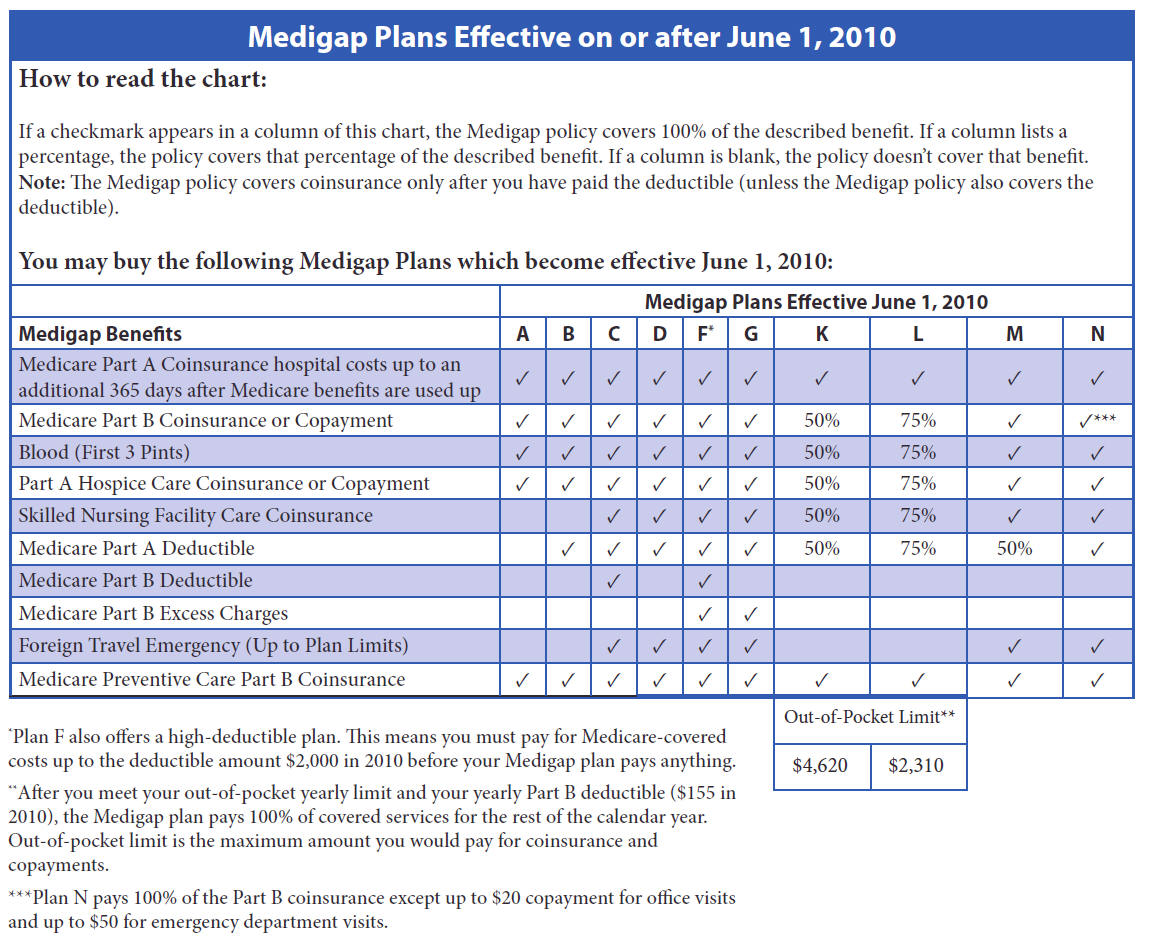

We are including a chart that better explains how each Modernized Texas Medicare Supplement Plan works below, take a look and see which plan you would feel to most comfortable with, pick 2 and then compare rates, that should get you started

Texas Medicare Supplements Provides Peace of Mind

What Type of Texas MediGap Policy can I Buy?

As you can see from the chart above there are 10 plan designs that will help or completely eliminate you left over out of pocket exposure from the items traditional Medicare does not cover. Like I mentioned earlier each plan is numbered using an alphabetical system, A through N. Some plans like Plan J no longer exist so the numbering system bounces around a bit but should be fairly easy to understand, again if not call us, we will help free of charge.

There is also a very low cost high deductible Plan F however it’s not very popular and unless you request it we won’t even present it. Since it was introduced not one senior has asked about it so all that I see can happen is create more confusion in an already confusing time, that of turning 65.

Texas Medicare Supplement Policies: Listing by plans

Well, for starters lets look at what the federal government requires as minimum standards each and every supplemental policy or MediGap plan must do.

Medicare Part A Coverage:

Medicare Part B Coverage:

Ok, so there are the basic minimum standards of any supplement policy. The below is a breakdown of what each available policy will cover.

What Type of Medicare Supplement policy Can I Buy?

Medicare Supplement Plan A

Medicare Supplement Plan B

Medicare Supplement Plan C

Medicare Supplement Plan D

Medicare Supplement Plan F

*There is also a high deductible option available for this popular plan of $2000 at a much reduced price, however as of yet this plan is not requested often enough to provide a separate benefit description.

Medicare Supplement Plan G

Medicare Supplement Plan K

Medicare Supplement Plan L

Medicare Supplement Plan M

Medicare Supplement Plan N

Like we said earlier, Texas Plan F is the most popular, it always has been and probably always will be, but that does not mean it’s the best for you. We advise you to contact a qualified, licensed independent broker to discuss your options. There is never a fee associated with using a broker and the price you pay for your coverage is the exact same as if you called the insurance company direct and bought from them. This is due to state laws. Using a Texas Medicare Supplement Broker make sense during this confusing time.

After you have selected your correct plan it would always be a good idea to select a Texas Medicare Part D Prescription Drug Insurance Plan to do two things: First, help offset the current cost of your daily medications and also to offer protection on any future medications you could find yourself taking. Failure to select a Part D plan can result in future financial penalties if at some point in the future you decide to enroll in the Part D Drug card.